Business

South Korea Presidential Election 2025: Students Embrace AI's Future Potential While Questioning Candidates' Preparedness for Tech Leadership

- 2025-06-03

- Politics

- By: Wang YunqiEdited by: BO Chuxuan

- 2025-06-03

Young voters in South Korea expressed different views on increasing funding for AI development, as some presidential candidates have mentioned AI in their speeches, amid the country's rising financial input for technology research and development. “I think it’s kind of a waste of money because we already have technologies like GPT, and China has DeepSeek. Developing AI requires a lot of information and money,” said Kim Jun Young, an English Education student at Korea University. “Still, we don’t really have sufficient resources to compete on the same level,” she added. Park (assume name), 26, majored in computer science, has also expressed doubts about the practicality and feasibility of AI policies proposed by different candidates. “ I’m doubtful whether they can achieve meaningful advancements in this field,” he said, adding that he thinks many candidates do not understand AI much. South Korea recently increased the research and development budget for 2025 by 16.1 percent year-on-year to a record high of KRW 24.8 trillion (HK$ 141.4 billion) with a focus on cutting-edge technologies such as artificial intelligence (AI), biotechnology, and quantum technology. The ambitious investment aims to position South Korea as a global leader in these fields. Lee Jae-myung, the presidential candidate of the Democratic Party, who leads the poll, has identified AI, renewable energy, and the cultural industries as essential tools for addressing South Korea’s economic challenges meanwhile Kim Moon-soo, first runner-up in the poll, from the conservative People Power Party, promote himself by creating a joint fund to boost AI development. Meanwhile, Lee Jun-seok, the youngest candidate among all, representing the Reform New Party, emphasises the importance of data freedom in AI development and highlights the role of Large Language Models (LLMs) in advancing the industry. AI has become a core driving force for national development, with applications spanning industries …

New Gold Zone at 2025 International Jewellery Show boosts Hong Kong’s position as trading hub

- 2025-03-04

- Business

- By: Yichun FangEdited by: WANG Ruoshui、XIA Fan、BO Chuxuan

- 2025-03-04

The 41st Hong Kong International Jewellery Show kicking off on Tuesday, debuts the Gold Jewellery Zone at the Convention and Exhibition Centre, with international gold exhibitors drawn in. The Hong Kong Trade Development Council (HKTDC) describes this new addition as a showcase for novel gold jewellery design, part of efforts to strengthen the city’s position as a global hub for gold jewellery trade. Organised by the HKTDC, the Jewellery Show will run from 4 to 8 March, showcasing new product trends including affordable luxury jewellery, men's and unisex jewellery, sustainable development and jewellery technology. “Hong Kong is actively accessing both the technical support of mainland China and the international market, so I hold a strong belief that the gold market here will become increasingly prosperous,” said Winston Chow, director & deputy general manager of Chow Sang Sang Holdings International Ltd. HKTDC said that Hong Kong is leading in the gold product sector. Currently, manufacturers are conducting high value-added processes in Hong Kong, while shifting manufacturing activities to mainland China. Atticus Zhu, the founder of Shenzhen Shangpin Gold Jewellery company exhibiting in the gold jewellery area, said that the consumers of the Hong Kong gold market accept the premium of labor cost on design to a greater extent than mainland Chinese customers, who are relatively more sensitive to the gold price. “Hong Kong is the global hub for gold jewellery trade, providing a springboard to tap into various international markets,” he added. “For example, through Hong Kong, we reached out to the Malaysia market, a country with a 20% overseas Chinese population and has one of the most receptive markets for gold today. ” The gold price rose more than 25% in 2024, the most significant annual gain in 14 years, as regional wars and political changes continued the uncertainty among …

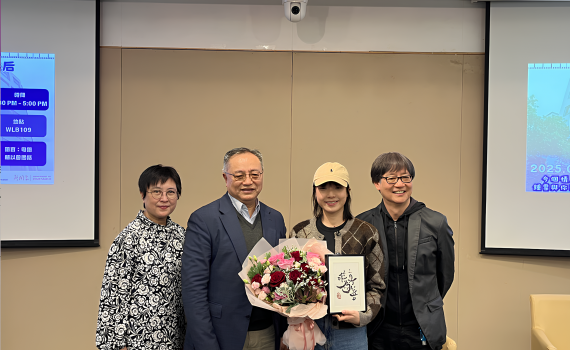

Golden Horse Best Actress playing deaf girl brings attention to vulnerable group films

- 2025-03-04

- Business

- The Young Reporter

- By: ZHAO Runtong、XIA FanEdited by: XIA Fan

- 2025-03-04

Chung Suet-ying, winner of the Golden Horse Film Best Leading Actress, called for more attention to be allocated to locally independent films while thanking fans supporting the film The Way We Talk at the special screening of Hong Kong Baptist University Communication School, her alma mater. The movie explores the choice of hearing-impaired people between using cochlear implants(electronic devices to improve hearing) or simply using sign language. Sophie Fong, played by Chung Suet-ying, was such a girl getting confused between the two advocacies and later decided to follow inner voices for living her own life. As of March 3, the movie achieved a box office of HK$ 5.35 million, ranking the fourth among all movies that have been released locally within the month. Also, nearly 60% of the audience on the Internet Movie Database (IMDB) gave the movie a score above or at eight out of ten. As for awards winning, besides Chung locking in the "Best Leading Actress" at the Golden Horse Film Awards, the movie also secured the Audience Choice Award and the Hong Kong Film Critics Society Recommended Movies Award. "Some worried a movie about ‘deaf people’ will not be popular, but I have confidence in the Hong Kong audience, which was proved by the award we got," said Adam Wong Sau-ping, the director on his Facebook page after winning the "Audience Choice Award" at the Hong Kong Asian Film Festival. “It is a discussion of identity politics,”said the Hong Kong Film Critics Society. “Adam Wong Sau-ping three-dimensionally presents the intersecting situation of deaf people and hearing people, and the diverse faces of their life circle,” the society added. Despite the positive reception of Wong’s film, local productions face challenges in Hong Kong’s competitive market. Only three of the top ten box office movies released in 2025 …

Digital Asset Week Hong Kong 2025 took place as Asia Pacific’s first tokenised retail fund prepares to be launched

- 2025-02-27

- Business

- By: Haoming Zhou、XIA FanEdited by: ZHAO Runtong、XIA Fan、BO Chuxuan

- 2025-02-27

Digital Asset Week Hong Kong 2025 kicked off with the Leadership Summit on Wednesday, bringing global traditional and digital asset insiders together, amid the launch of the Asia-Pacific’s first tokenised retail fund in the near future. “Digital Asset Week is the best event to connect to the people building the future of the digital asset ecosystem,” said Daniel Coheur, co-founder and chief commercial officer of Tokeny, an on-chain finance operating system developing company headquartered in Luxembourg. Known for inventing the ERC3643, one of the newest token standards for tokenisation of the Real World Asset in the blockchain, Tokeny plans to expand the number of employees in Hong Kong to capitalise on the opportunity. Confident about the industry's future, Thomas Zhu, Head of Digital Assets and Family Office Business of China AMC (HK), who will launch Asia Pacific’s first tokenised retail fund tomorrow, is confident about the future development of digital assets. Supported by Standard Chartered Bank, the tokenised retail fund will offer investors “opportunities to earn returns in Hong Kong dollars” through blockchain-based instruments. “We may be able to build another Chinese asset management company on the chain through blockchain technology,” he said. Hong Kong has recently taken action to boost digital assets, including preparing to issue the third tranche of digital bonds through the Hong Kong Monetary Authority, the city’s de facto central bank, and the hosting of Consensus 2025, the world’s top crypto and Web3 summit. Up to now, 10 virtual asset trading platforms have been operating in Hong Kong in the past five years, with the HKEX Bitcoin Reference Index surging more than 870%. As a response to its increasing development, the Hong Kong Securities and Futures Commission launched the “A-S-P-I-Re” for the regulatory roadmap for Hong Kong’s virtual asset market with 12 significant initiatives. “These movements …