Business

Golden Horse Best Actress playing deaf girl brings attention to vulnerable group films

- 2025-03-04

- Business

- The Young Reporter

- By: ZHAO Runtong、XIA FanEdited by: XIA Fan

- 2025-03-04

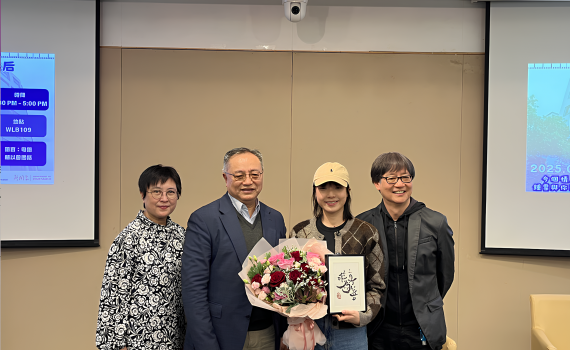

Chung Suet-ying, winner of the Golden Horse Film Best Leading Actress, called for more attention to be allocated to locally independent films while thanking fans supporting the film The Way We Talk at the special screening of Hong Kong Baptist University Communication School, her alma mater. The movie explores the choice of hearing-impaired people between using cochlear implants(electronic devices to improve hearing) or simply using sign language. Sophie Fong, played by Chung Suet-ying, was such a girl getting confused between the two advocacies and later decided to follow inner voices for living her own life. As of March 3, the movie achieved a box office of HK$ 5.35 million, ranking the fourth among all movies that have been released locally within the month. Also, nearly 60% of the audience on the Internet Movie Database (IMDB) gave the movie a score above or at eight out of ten. As for awards winning, besides Chung locking in the "Best Leading Actress" at the Golden Horse Film Awards, the movie also secured the Audience Choice Award and the Hong Kong Film Critics Society Recommended Movies Award. "Some worried a movie about ‘deaf people’ will not be popular, but I have confidence in the Hong Kong audience, which was proved by the award we got," said Adam Wong Sau-ping, the director on his Facebook page after winning the "Audience Choice Award" at the Hong Kong Asian Film Festival. “It is a discussion of identity politics,”said the Hong Kong Film Critics Society. “Adam Wong Sau-ping three-dimensionally presents the intersecting situation of deaf people and hearing people, and the diverse faces of their life circle,” the society added. Despite the positive reception of Wong’s film, local productions face challenges in Hong Kong’s competitive market. Only three of the top ten box office movies released in 2025 …

Digital Asset Week Hong Kong 2025 took place as Asia Pacific’s first tokenised retail fund prepares to be launched

- 2025-02-27

- Business

- By: Haoming Zhou、XIA FanEdited by: ZHAO Runtong、XIA Fan、BO Chuxuan

- 2025-02-27

Digital Asset Week Hong Kong 2025 kicked off with the Leadership Summit on Wednesday, bringing global traditional and digital asset insiders together, amid the launch of the Asia-Pacific’s first tokenised retail fund in the near future. “Digital Asset Week is the best event to connect to the people building the future of the digital asset ecosystem,” said Daniel Coheur, co-founder and chief commercial officer of Tokeny, an on-chain finance operating system developing company headquartered in Luxembourg. Known for inventing the ERC3643, one of the newest token standards for tokenisation of the Real World Asset in the blockchain, Tokeny plans to expand the number of employees in Hong Kong to capitalise on the opportunity. Confident about the industry's future, Thomas Zhu, Head of Digital Assets and Family Office Business of China AMC (HK), who will launch Asia Pacific’s first tokenised retail fund tomorrow, is confident about the future development of digital assets. Supported by Standard Chartered Bank, the tokenised retail fund will offer investors “opportunities to earn returns in Hong Kong dollars” through blockchain-based instruments. “We may be able to build another Chinese asset management company on the chain through blockchain technology,” he said. Hong Kong has recently taken action to boost digital assets, including preparing to issue the third tranche of digital bonds through the Hong Kong Monetary Authority, the city’s de facto central bank, and the hosting of Consensus 2025, the world’s top crypto and Web3 summit. Up to now, 10 virtual asset trading platforms have been operating in Hong Kong in the past five years, with the HKEX Bitcoin Reference Index surging more than 870%. As a response to its increasing development, the Hong Kong Securities and Futures Commission launched the “A-S-P-I-Re” for the regulatory roadmap for Hong Kong’s virtual asset market with 12 significant initiatives. “These movements …

Budget 2025: Hong Kong to issue third tranche of tokenised bonds and boost digital bonds market

- 2025-02-26

- Business

- By: Haoming Zhou、WANG RuoshuiEdited by: BO Chuxuan

- 2025-02-26

Hong Kong will continue to encourage the issuance of digital bonds through the Digital Bond Grant Scheme and prepare the third tranche of tokenised bond issuance, said Paul Chan, the financial secretary, at his 2025 Budget Speech on Wednesday. The government will explore measures to enhance the wider adoption of bond tokenisation and tokenising traditional bonds, said Chan. “Any movement conducive to the promotion of digital bonds is a good thing,” said Simon Lee, a member of the Legislative Council of Hong Kong, “there has to be enough diversified products to activate the market, so that Hong Kong's position in the financial market can be consolidated.” HKMA has issued two batches of tokenised green bonds, HK$ 800 million in February of 2023 and around HK$ 6 billion in February of 2024, enabling tokenisation to move beyond the proof-of-concept stage to the practical application level. Tokenised bonds, issued and traded with blockchain technology, are a type of digital bond, which globally has reached an issuance value of US$3.9 billion (HK$ 30 billion) by the end of March 2023, according to the Hong Kong Monetary Authority. To encourage more institutions to participate in the issuance of digital bonds, the Digital Bond Grant Scheme (DBGS), a three-years grant scheme of up to HK$2.5 million to cover the eligible digital bond issuance costs, was announced in November last year, after first introduced on Oct. 16, 2024, in the 2024 Policy Address. The echo comes in quick succession as Singapore launched Global-Asia Digital Bond Grant Scheme (G-ADBGS), a five-year digital-bonds-supporting scheme, to promote the issuance of digital bonds in January 2025. “I would consider tokenised bonds as a very good way to invest,” said Chen Shiyi, a virtual asset investor from mainland China who works at Pleasanton Ventures Limited, …

Hong Kong officials' pay freeze as government addresses fiscal deficit

- 2025-02-26

- Business

- By: ZHAO Runtong、Yichun FangEdited by: XIA Fan

- 2025-02-26

The Hong Kong government plans to freeze salaries of all executive, legislative, judicial and district council staff in fiscal year 2025-26, said Financial Secretary Paul Chan Mo-po in the budget speech today. “This(salary freeze) includes the chief executive and politically appointed officials; the non-official members of the executive council; members of the civil service; the president, all members, and secretariat of the Legislative Council; chief justice of the Court of Final Appeal, judges of the courts at all levels; and other members of the judiciary; and members of the District Councils,” said Chan. The Financial Secretary further announced that the civil service establishment will be cut by 2% each fiscal year from 2026-27 to 2027-28, a total of about 10,000 positions. "The government took the improvement of economic conditions and room for private market salary increase into consideration,” said Chan in the press conference, “freezing civil servants’ salaries is more appropriate than cutting them.” Reported as HK$87.2 billion for the fiscal year 2024-25, the expected consolidated budget deficit nearly doubles the government's initial forecast. On the other hand, Hong Kong hired approximately 173,000 civil servants to serve about 7 million population, while in comparison, Singapore employed about 86,000 workforces for around 5 million residents. “It (a pay freeze) is a sign of commitment to reduce expenditure,” said Linda Li Che-lan, Associate Head of Public and International Affairs at the City University of Hong Kong. “But we cannot rely on a pay freeze for civil servants to effectively cover the deficit.” Leung Chau-ting, the chairman of Hong Kong Federation of Civil Service Unions, worries that a pay freeze for public servants would cause a chain-reaction. “The decision can trigger large-scale wage freezes across industries following the authorities’ move, causing harm to the benefits for other non-government employees,” said Leung. The salary …

Hong Kong seizes crypto opportunities as Consensus’ Asian host

- 2025-02-19

- Business

- By: WANG RuoshuiEdited by: Yichun Fang、BO Chuxuan、XIA Fan

- 2025-02-19

Hong Kong bolsters its local Web3 industry as it welcomes the world’s top crypto and Web3 summit, Consensus, to launch its Asian debut today, reflecting its growing role as a global hub for virtual asset innovation. The event, organised by the US crypto news outlet CoinDesk, is one of the industry’s biggest conferences. Expected to draw over 8,000 attendees, including 6,000 international delegates, the conference’s agenda underscores the latest topics and trends in the Web3 space. Financial Secretary Paul Chan said in the opening talk that Hong Kong would promote the development of the cryptocurrency market by introducing a series of policies, with nine virtual asset trading platform licenses already issued and more in the pipeline. According to Julia Leung, Chief Executive Officer of the Hong Kong Securities and Futures Commission, virtual assets now enter the second phase, and Hong Kong is developing a pro-growth strategy. Leung added that Hong Kong will first complete the legislation on virtual asset activities, followed by expansions of its products and services, and then optimise operational processes, including hot wallet and cold wallet provisions. Hong Fang, president of OKX, a licensed crypto trading platform in Hong Kong, pointed out that jurisdictions around the world are stepping up the compliance process in the digital asset space as the US accelerates its cryptocurrency regulatory system. She emphasised that the clarity of US regulatory policy is triggering a chain reaction in the international market, prompting regulators in different regions to introduce complementary measures in response to industry changes. However, CoinW, a comprehensive crypto-asset trading company, is still on its way to pursuing a compliance license this year. Man Yeung, the Business Development Manager of CoinW, hopes for more transparent and more explicit guidelines to smooth the application procedure. Over the past year, local media have reported cases …

Bubble-tea giant Guming delivers first-day slump amid saturated market

- 2025-02-12

- Business

- By: ZHAO RuntongEdited by: Haoming Zhou、XIA Fan、BO Chuxuan

- 2025-02-12

Shares of bubble tea seller Guming Holdings Ltd. reversed direction after a mild rise during its trading debut on Wednesday at Hong Kong, closing with a first-day slump. Trading under the code 1364, the stock of Guming rose to an intraday high of HK$10.4 before dropping 6.4% from the offer price to HK$9.3 at closing. The Hang Seng Index added 2.64% to 21857.92 as of market close. Priced at HK$ 9.94 in its initial public offering, at the top of an indicated range, Guming successfully raised $232 million in Hong Kong two days before its trading debut. 5 cornerstone investors were introduced in its IPO with a total amount of US$71 million invested, including Huang River Investment, a subsidiary of Tencent Holdings. Guming also achieved about 195 times oversubscription, which was the second best performance among tea beverage concept stocks, surpassing Chapanda but lower than Nayuki’s 430 times. “The plunge of Guming’s trading debut is due to the oversaturated market in China,” said Louis Wong Wai-jie, director of Phillip Securities, “the buyers are not optimistic about the industry’s prospects.” China’s bubble tea market has developed rapidly in the past decade, with more than 60,000 related enterprises being newly registered every year since 2017, and the market value of the industry grew to more than 300 billion RMB (HK$319. 59 billion) in 2024, according to Statista research experts. As of today, the stock price of Chapanda, also known as CHABAIDAO, has dropped nearly 23% since its IPO in April last year, while the stock price of Nayuki Holdings Limited, China’s leading tea beverage brand, plunged more than 92% to HK$1.29. As the leader of mid-priced bubble tea, which holds 17.7% of market share based on the Gross Merchandise Value in 2023, Guming choose to distribute nearly 80% of its stores in …

From hotel to hostel: new property investment trend amid rising beds demand

- 2025-02-12

- Business

- By: BO Chuxuan、WANG Ruoshui、Haoming ZhouEdited by: Chi On LIU

- 2025-02-12

Lying in bed, Ren Ziyu, a 19-year-old university student, reflects on her fulfilling day— working out in the morning, reviewing in the study room, preparing presentations with teammates, and playing board games with friends. Surprisingly, she hasn't taken any step out of her student apartment, Y83, for the whole day. “I often spend my whole days off in Y83 because it fulfils my needs of studying, exercising, socialising and entertaining,” said Ren. Y83, under the Y.X. property, owned by Crystal Investment, provides accommodation and a co-living community for only college students with extensive facilities, shared lounge activities, and even discount tickets for entertainment. Located on Wuhu Street in Hung Hom, student residence Y83 was formerly known as “Hotel SAV Hong Kong”, which was jointly acquired by Crystal Park and US property fund AEW for $1.65 billion in 2022. Crystal Investment spent HK$343 million to acquire an Ease Access Hotel in Cheung Sha Wan and an Incredible Residences residential & commercial building in Hung Hom in June and August to convert into student accommodation. “We are pleased to complete two significant acquisitions in a short time and are optimistic about the development of the private student accommodation market since the rising demand for accommodation driven by increasing non-local students in recent years,” said Andrew Chan, Chief Investment Officer of Crystal Investment. “We will continue the acquisitions in the core area in Kowloon District, aiming to contribute to the private property market in Hong Kong.” The growing student property market has attracted other property investment companies. Centaline Investment, renowned for property investments in overseas student residences, has also set its sights on Hong Kong, spending HK$180 million on Sep. 9 to purchase the Park Lane Hotel in Hong Kong, which will be refurbished into student residences with 150 beds. The survey from …