Fake Crypto Exchanges: Insights from South Korea's Frontline

- By: Subin JO、Runqing LIEdited by: Chi On LIU、Ji Youn Lee

- 2024-06-13

The cryptocurrency has become one of the significant investments in South Korea.

According to Statista Market Insight, the total revenue of the cryptocurrency market has doubled from 2018 to HK$ 12.3 million in 2023 and recorded the highest in 2021 with a value of HK$ 33.2 million. Meanwhile, the total number of cryptocurrency users has increased more than seven times in the last five years since 2018.

As the cryptocurrency market grows, so does the incidence of fraud, mainly through fake cryptocurrency exchanges, highlighting the need for increased vigilance among investors in South Korea.

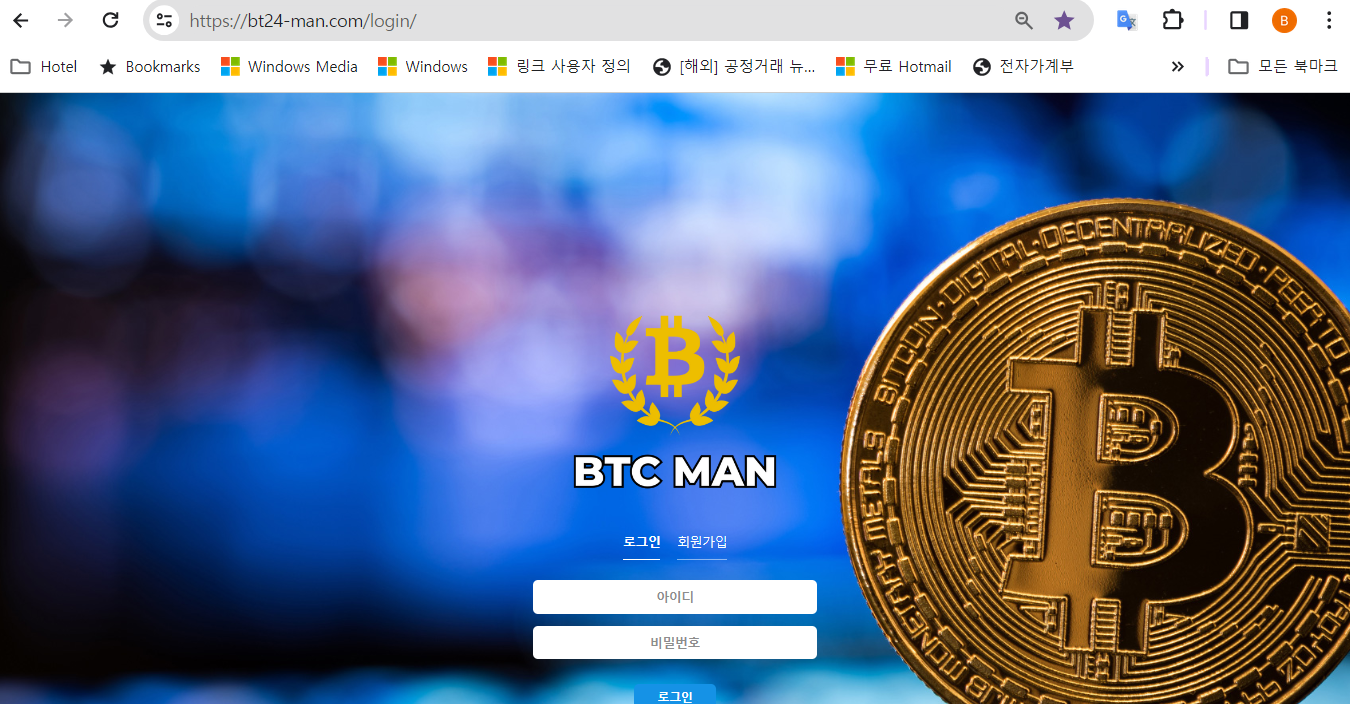

"When I tried to cash out profits, the cryptocurrency exchange started giving me the runaround. They kept stalling and making up excuses left and right,” said Kim Hyun Jin, 41, a cryptocurrency scam victim by the BTC Man, from South Korea.

Kim added that to make matters worse, they started demanding more money, claiming it was for taxes or setting up virtual accounts.

After stumbling upon a seemingly innocent stock discussion group, Kim was defrauded of around HK$ 350,000 in an online group chat.

The group initially offered daily market insights, stock recommendations, and testimonials from purportedly successful members, which attracted Kim to join the telegram community.

However, the chatroom was silent after Kim did not get his guaranteed return.

“I reached out to the group leader for guidance. Surprisingly, the leader offered to make a substantial personal investment to cover my losses. It seemed like the leader genuinely cared about my well-being and success in trading,” Kim said.

However, the exchange claimed Kim needed to deposit more money to withdraw his profit.

When Kim contacted the admin again, he was kicked out of the chat room.

“I got a bunch of empty promises, and it left me feeling pissed off and hopeless," Kim said.

Serena Kim, 32, a lawyer at Lee & Ko, explained that victims have the right to initiate civil and criminal proceedings in fraud involving virtual assets.

“In South Korea, criminal cases are primarily filed with the police, but fraud, embezzlement, and breach of trust involving amounts over 5 billion KRW (HK$ 28.5 million) can be put under prosecutors,” said Lee.

Following the heightened alert for virtual asset crimes by Korean prosecutors, the Korean government has launched a joint investigation team with the Financial Supervisory Service and the Financial Intelligence Unit to address crimes related to virtual assets strictly.

On Mar. 20, the Korean Financial Supervisory Service issued Consumer Alert No. 2024-12, cautioning against virtual asset investment scams. The FSS emphasised verifying whether a virtual asset exchange has been reported before use.

Additionally, they cautioned against investment recommendations through online investment chat rooms and social media platforms and advised against transferring large sums of money when using unverified private exchanges.

The issue of cryptocurrency fraud and fake cryptocurrency exchanges is getting more severe in South Korea and around the world.

According to the FBI's 2023 Internet Crime Report in the US, investment fraud related to cryptocurrency increased from US$2.57 billion (HK$20.13 billion) to US$3.96 billion (HK$31.01 billion) in 2023.

In China, police from different provinces continued operations to combat-related crimes. In February 2024, Dalian’s Securities Authority and six other agencies issued a notice to warn the public about being targeted by cryptocurrency fraud. They highlighted that 'some criminals have used the names of "virtual currency" and "Metaverse", and under the banner of "sharing wealth and business opportunities", to trick investors into downloading software and investing in its illegal virtual currency'.

Stray Zhou, 24, a fresh graduate from Mainland China, was introduced to cryptocurrency investment by his colleague and had been trading in the spot market.

Zhou had the habit of using VPNs to get access to “overseas applications” in Mainland China. He received a private message on Telegram, which told him that making money on trading spot cryptocurrency was “too slow”.

“The scammer was clever and chatted with me for a few days, patiently taught me the knowledge of cryptocurrency,” Stray Zhou said.

“Then it was the point that he suddenly told me that there was a cryptocurrency project that he had been tracking for a long time, which is said to have a ‘good narrative’ and there is a high possibility to earn,” Stray added.

Zhou did not care about it at first. However, the scammer sent him the website to buy the cryptocurrency and asked him to buy it when it was time.

Zhou bought little at the beginning. However, the price rose to 1500% once, and the scammer said Zhou could increase the position.“The scammer said there was still room to increase, and I could earn bonus currency if I held a certain position. I was obsessed with cryptocurrency and kept adding money inside until the scammer deleted my contact information, and I found I could not trade it,” Zhou said.

Zhou was defrauded of his graduation savings, which amounted to HK$66,149.

“The first time I entered an unfamiliar field taught me such a huge lesson. I thought I had a strong sense of anti-fraud, but when it comes to areas I am not familiar with, I have been cheated and lost everything,” Zhou said.

“A developer might control its cryptocurrency to defraud people who had never invested in the cryptocurrency, and scammers could steal the investor’s crypto directly through a phishing website,” said Zip Zhou, 30, a blogger who shares his five-year investment experience in various cryptocurrencies.

As an investment product highly related to information technology, it is harder to prevent a cryptocurrency scam than a traditional defraud, even for an experienced investor like Zhou.

After exchanging with a fake account, $1000 worth of cryptocurrency in Zhou’s account disappeared.

“The fake account has the same name, same profile, and even the same number of fans as the real account, and I did not look at it carefully. Scammers are always upgrading,” Zhou said.

Although cryptocurrency exchange is anonymous, some capable investors could track the scammer's IP address and retrieve their losses, Zhou added.

Lee emphasised the need for individuals to establish a sound investment philosophy and thoroughly research the virtual assets they plan to invest in to prevent fraud related to virtual assets.

To avoid cryptocurrency scams, consumers may read legal documents to check their liability and keep concrete documentation of all transactions and communications.

"There have been actual cases where people invested large amounts in virtual assets without keeping any documentation such as investment agreements, which later made it difficult to prove the terms of the agreement when taking civil and criminal action,” Lee said.

《The Young Reporter》

The Young Reporter (TYR) started as a newspaper in 1969. Today, it is published across multiple media platforms and updated constantly to bring the latest news and analyses to its readers.

How Green Roofs Can Encourage a Green City Revolution

Impact investment: change the world and return a profit

Comments