Hong Kong welcomed its largest tech sector IPO in three years in late October, when Horizon Robotics, a Chinese autonomous driving firm, succeeded in raising a total fund of HK$ 5.4 billion.

The debut was similar to that of Midea, a Chinese home appliances manufacturing and retail company, which filed its initial public offering in late September, making it the city’s largest IPO since 2021.

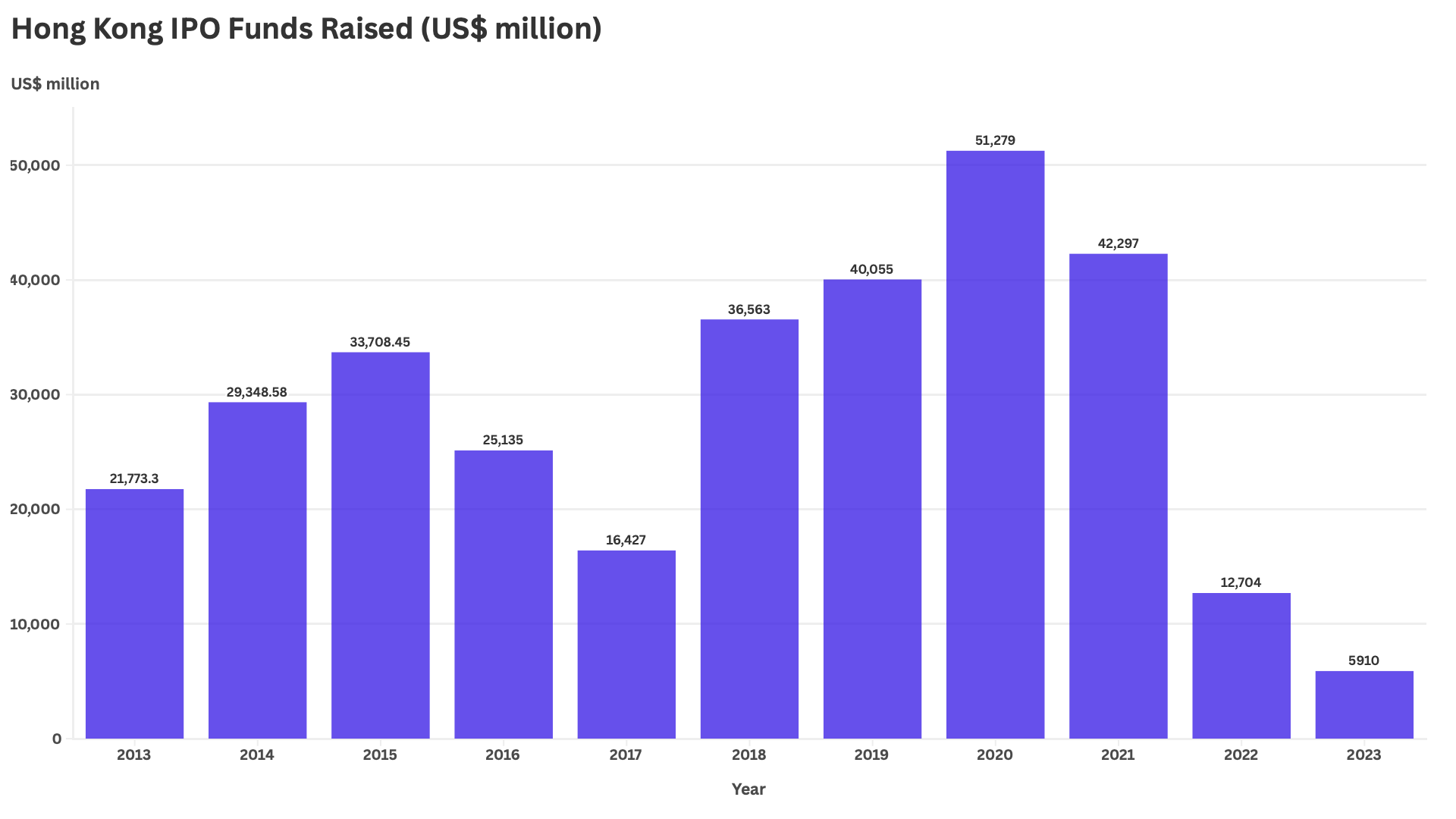

Despite these IPOs providing some much-needed momentum, Hong Kong’s sluggish stock market is experiencing one of its slowest years for listing in the past decade.

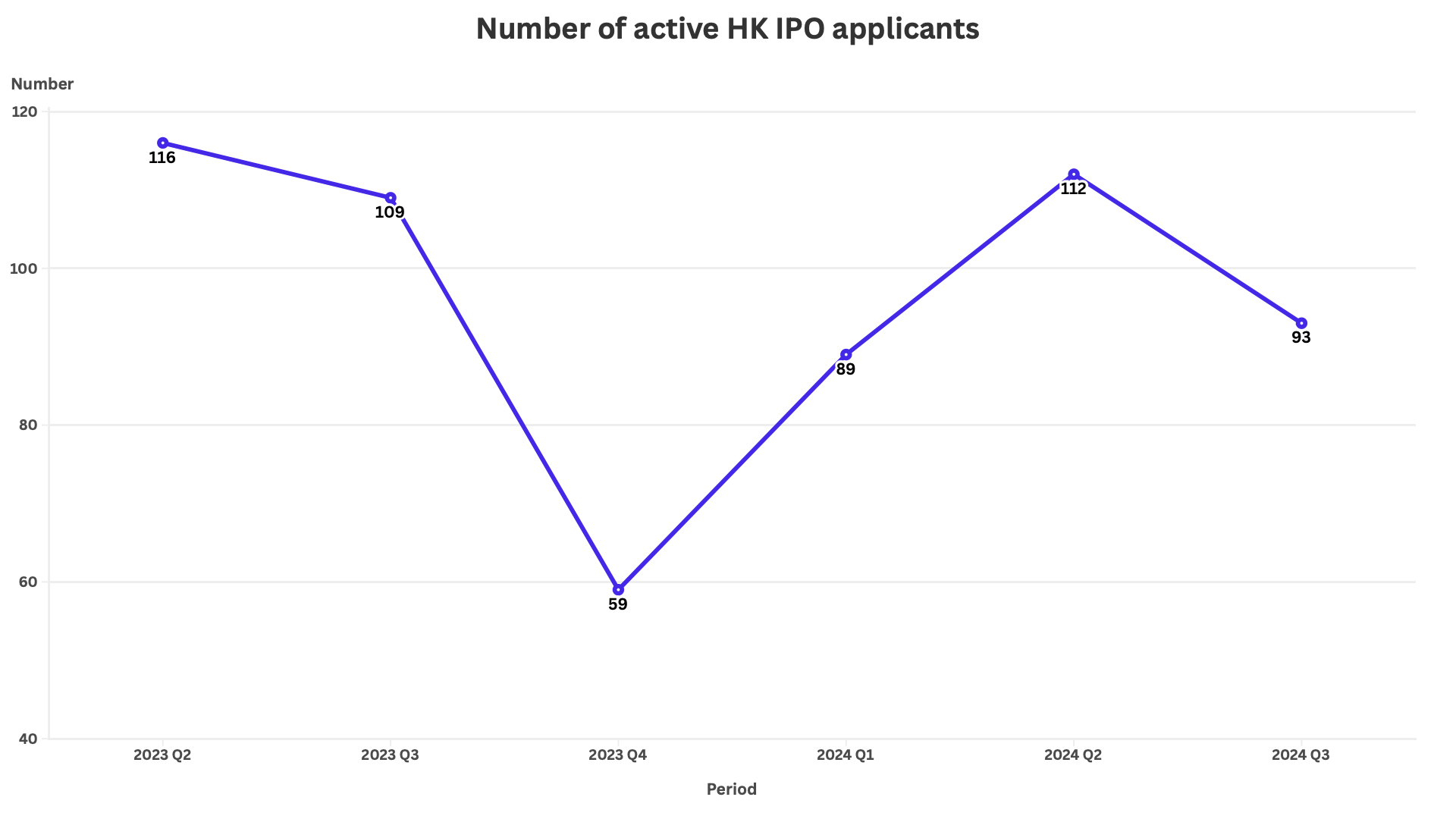

KPMG reported that in the first quarter of 2024, only 12 new companies succeeded in listing in the local stock market, marking a 35% fall on a year-on-year basis, with a total annual fall of 30% to HK$ 4.7 billion raised. Proceeds from IPOs in the first quarter of 2024 were the lowest since 2009, as the city's worldwide ranking for IPOs fell outside the top five.

Hong Kong stepped up its effort to boost the local stock market, aiming to regain its reputation as the world’s leading capital hub.

Earlier in March, the HKEX amended its listing rules, easing specialist technology companies' access to go public, known as Chapter 18C. The regulators lowered the valuation threshold for listing in Hong Kong at the end of August.

The measure responds to the big companies’ waning interests in the Hong Kong stock market. Giant tech companies such as e-commerce platforms Alibaba and electric vehicle manufacturer NIO Inc. all put listings in the US as their first choices.

“Technology stocks are vital players and propelling powers in stock markets, as they are often at the forefront of innovation, offering promising growth to investors,” said Ju Wang, the head of greater China strategy at BNP Paribas. “The US is the most successful market attracting tech stocks, and the listing valuation bar there tends to be more generous than Hong Kong, ” she added.

“Hong Kong is competing globally, and it wants to nurture some startup tech companies with great potential in its stock market, " said Kiyong Seong, the lead Asia strategist of Societe Generale Hong Kong.

Besides IPO, Hong Kong’s secondary fundraising market is rising. The Hang Seng Index surpassed the floor of 20,000 for the first time in 2024 in late September.

“Stocks listed in Hong Kong showed signs of rising. This gives investors confidence to enter or re-enter the market,” said Wong Wenka, an individual stock trader at HKEX, who quit investing in tech stocks after the Hang Seng Tech Index plummeted in 2022.

However, massive stock market declines in early October. She indicated an uncertain recovery path and said China remains a significant factor in the Hong Kong stock market.

Mainland Chinese companies represent the majority of listings on the HKEX, accounting for 79.6% of the total market value and 87% of the total trading value as of the end of October.

Seong pointed out that mainland companies’ movements and stocks are easily affected by policies, as their “movements are in line with the policies announced by the Chinese government.”

Analysts say Investors were disappointed when Zheng Shanjie, chairman of the National Development and Reform Commission, did not announce any further stimulus measures at a conference in early October

The Hang Seng Index plunged more than 9% after the conference, the biggest fall in 16 years. However, just ten days before the significant decline, the index rocketed by 12.9%, the best performance in percentage change ever since the year 1998, which benefited from the reduced bank reserve requirement ratio announced by the People’s Bank of China.

“Hong Kong stock market depends on the progress of Chinese economic recovery, but the pace could be a bit slower,” added Seong. “So I'm cautiously optimistic about the situation.”

Deloitte reported positivity in its Q3 outlook report, saying Hong Kong is expected to complete listings of several substantial new stocks on its market before the end of 2024 if market conditions are ideal and China’s economy rebounds.

“We saw market sentiment improvement affected by factors like favourable policies, Chapter 18C moderation,” said Mike Tang, the partner of KPMG’s capital markets group. “However, the market remains challenging and could experience fluctuations shortly because of uncertainty.”

《The Young Reporter》

The Young Reporter (TYR) started as a newspaper in 1969. Today, it is published across multiple media platforms and updated constantly to bring the latest news and analyses to its readers.

Low rent at lunar new year fair helps small businesses

11 trail runners finish 2025 Hong Kong Four Trails with new rules

Comments