From hotel to hostel: new property investment trend amid rising beds demand

- By: BO Chuxuan、WANG Ruoshui、Haoming ZhouEdited by: Chi On LIU

- 2025-02-12

Lying in bed, Ren Ziyu, a 19-year-old university student, reflects on her fulfilling day— working out in the morning, reviewing in the study room, preparing presentations with teammates, and playing board games with friends.

Surprisingly, she hasn't taken any step out of her student apartment, Y83, for the whole day.

“I often spend my whole days off in Y83 because it fulfils my needs of studying, exercising, socialising and entertaining,” said Ren.

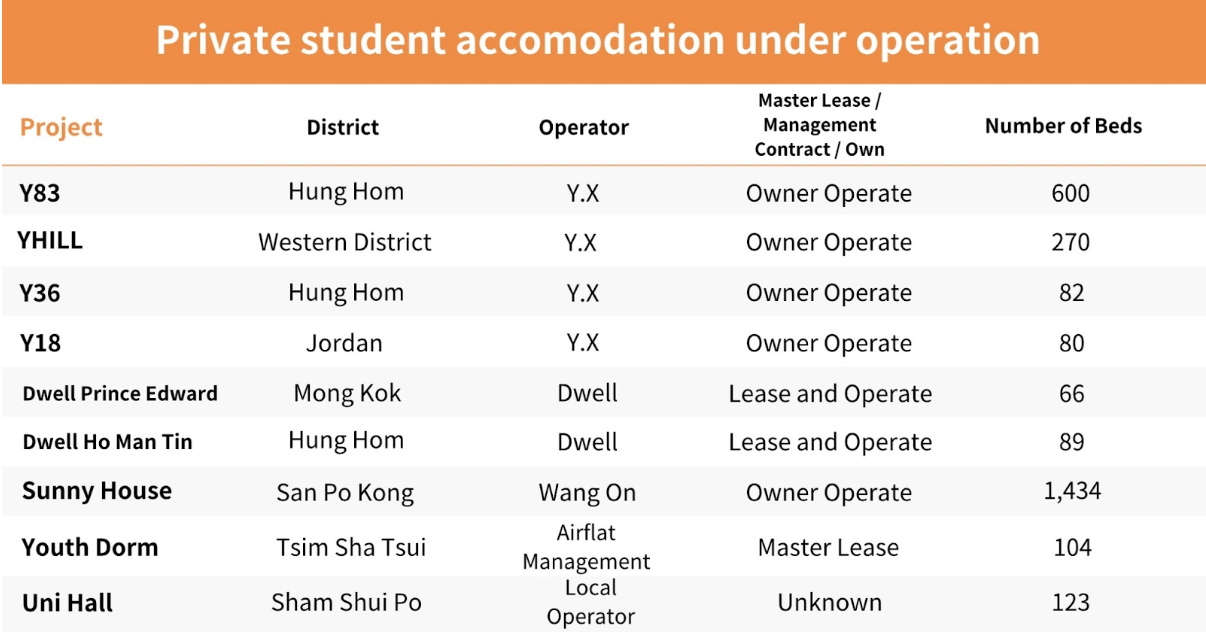

Y83, under the Y.X. property, owned by Crystal Investment, provides accommodation and a co-living community for only college students with extensive facilities, shared lounge activities, and even discount tickets for entertainment.

Located on Wuhu Street in Hung Hom, student residence Y83 was formerly known as “Hotel SAV Hong Kong”, which was jointly acquired by Crystal Park and US property fund AEW for $1.65 billion in 2022.

Crystal Investment spent HK$343 million to acquire an Ease Access Hotel in Cheung Sha Wan and an Incredible Residences residential & commercial building in Hung Hom in June and August to convert into student accommodation.

“We are pleased to complete two significant acquisitions in a short time and are optimistic about the development of the private student accommodation market since the rising demand for accommodation driven by increasing non-local students in recent years,” said Andrew Chan, Chief Investment Officer of Crystal Investment.

“We will continue the acquisitions in the core area in Kowloon District, aiming to contribute to the private property market in Hong Kong.”

The growing student property market has attracted other property investment companies. Centaline Investment, renowned for property investments in overseas student residences, has also set its sights on Hong Kong, spending HK$180 million on Sep. 9 to purchase the Park Lane Hotel in Hong Kong, which will be refurbished into student residences with 150 beds.

The survey from Colliers showed the gap between the demand and supply of student accommodation in Hong Kong.

In the 2023/2024 academic year, 264.3 thousand students were enrolled in Hong Kong’s post-secondary institutions, while only 4.3 thousand beds can be provided, including private, UGC, and non-UGC-funded institutions.

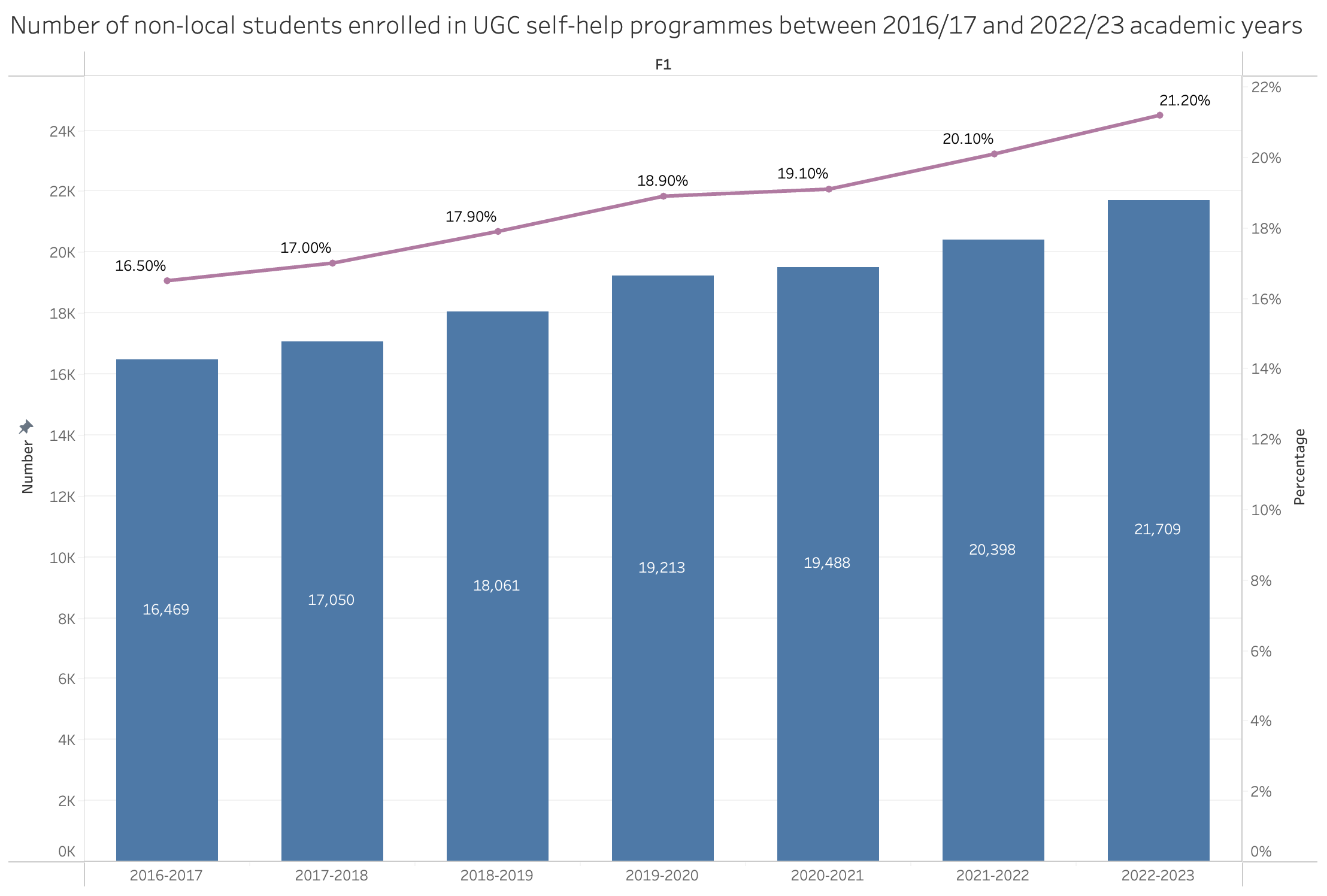

The number of non-local students enrolled in UGC-funded programmes soared from 16.5% in the 2016/2017 academic year to 21.2% in the 2022/2023 academic year, said the Legislative Council Secretariat.

Yan Jeun-man, the head of capital markets and executive director at CBRE Hong Kong, said the high ranking of Hong Kong universities and excellent education resources have made Hong Kong an international education hub a significant trend.

Hong Kong Chief Executive John Lee Ka-chiu doubled the admission quota of non-local students by government-funded post-secondary institutions to 40% in Policy Address 2023 to “attract more overseas and Mainland students to further study in Hong Kong” and build Hong Kong into an “international education hub and a cradle of future talent.”

“The number of non-local students will continue to grow, and the existing hostels can no longer meet the surge in demand for accommodation, which makes investing in student hostels a good direction,” said Chong Tai-Leung, executive director of Lau Chor Tak Institute of Global Economics and Finance.

“The number of non-local students will continue to grow, and the existing hostels can no longer meet the surge in demand for accommodation, which makes investing in student hostels a good direction,” said Chong Tai-Leung, executive director of Lau Chor Tak Institute of Global Economics and Finance.

“Although the upfront refurbishment cost is high, it is not difficult to recoup the cost at the current price as there is a steady demand for living in student hostels,” said Chong.

Though gaining popularity because of its diverse facilities and secure environment, student accommodations such as Y83 are losing customers because of its rising fees.

After careful consideration, Ren, who claimed to have a great time in the Y.X. community, decides to quit Y83 and rent a house with friends in a nearby residential building because she could not accept the soaring rental price.

“I may choose to find a single room in a normal residential building with three friends, with the ideal cost of around HK$5,500 per month,” Ren added.

With a bit of sacrifice for the environment, Ren is confident of renting an ideal and suitable room at a cost-effective price from a local landlord.

Hung Sam, a local landlord with three apartments in Yau Ma Tei, Jordan, and Tsim Sha Tsui, has sold her 15 student rooms within one week.

“Converting a house into student accommodation and subletting it to students yields 20% to 30% more than renting it out to locals,” Hung said.

“Converting a house into student accommodation and subletting it to students yields 20% to 30% more than renting it out to locals,” Hung said.

She believes that despite the competitive market, large student flats and hotel conversions are positioned differently, and she is mainly serving the student population who are looking for good value for money.

“I'm not worried about renting out my houses at all because the demand in the market is big enough,” Hung added.

“Large student flats target a different clientele from us due to high investment and operating costs and relatively high rents,” Hung added. “Our competitive advantages are personalised service, more affordable prices, and student care.”

Lee stated in the Policy Address 2024 that the government encourages the market to convert hotels and other commercial buildings on a self-financing and private basis.

Echoing the policy, universities in Hong Kong are also making efforts to expand their accommodation quotas for students.

Hong Kong Metropolitan University, investing HK$1 billion in acquiring the Citywood Hotel in Hung Hom, opened its new student hostel named MU88 in August.

Yu Chenjing, a 19-year-old freshman resident, pays about HK$8,000 for a single room in MU88, the hostels invested by her college, HKMU, and feels she is getting her money’s worth.

“Every room is new. I even bought my air purifier but didn’t test any formaldehyde problem, and the security measures are perfect,” Yu said.

She would consider living here even if the rent increased to around HK$10,000 for the following year.

“There is no better choice than this place in the neighbourhood, after all,” Yu said.

According to the official website of the HKMU, MU88 was put into operation in August this year. It is a 16-storey building with 255 rooms for about 480 residents, all with en-suite bathrooms.

“The cost of converting a hotel into student accommodation may be difficult to recover for the school fully,” Chong said. He stressed that despite the challenges, it is a viable way to address the shortage of student accommodation.

On the contrary, for those who are also the subject of renovation, such as property developers, CBRE’s Yan said student flats converted by property developers can be rented out at a profit rate of 5% to 5.5%.

As for investing so much money in the dorms, an HKMU spokesperson added that MU88 enables more non-local and exchange students to study at HKMU to enhance the student’s learning experience and promote a higher degree of internationalisation on campus.

The number of international students is expected to grow continuously as Hong Kong develops into a global study market.

Chong said converting hotels into student hostels is a viable way to address the accommodation shortage, but attention needs to be paid to site selection, scale and market demand.

“The government, investors and universities need to work in tandem to promote the sustainable development of the education industry and enhance Hong Kong's international competitiveness while paying attention to the actual needs and affordability of students,” Chong said.

《The Young Reporter》

The Young Reporter (TYR) started as a newspaper in 1969. Today, it is published across multiple media platforms and updated constantly to bring the latest news and analyses to its readers.

Standard Chartered Hong Kong Marathon kicks off with expo at new sports park

Jellycat selling emotions: how plush toys become an adult fad

Comments