Nikkei 225, Japan’s premier stock market index tracking the performance of 225 large publicly traded companies listed on the Tokyo Stock Exchange, opened at 37572.36 today and dropped 0.68% to 37480.37 as of the market's end. TOPIX, an index overing all domestic common stocks mostly listed on the TSE Prime Market, traded higher at midday at 2744.16, but later reversed course and closed at 2740.45, down 0.075% compared with yesterday. Performances of Japan’s stock market aligned with global cautious sentiment after Moody’s downgraded the US government's top credit ratings.

Export-oriented stocks went up amid the falling market. Pharmaceutical company Daiichi Sankyo surged 7.06% to 3,698 yen, which continued the growth trend since last week. Manufacturer Konica Minolta added 6.31% to 469 yen, while Mitsubishi Heavy Industries rose 3.04% to all time highs of 2,916 yen. Beverage company Sapporo Holdings jumped 2.92%to 7613, showing a trending up from the 3-month low on May 14. Analysts believe the weakening Japanese yen fostered a favorable environment for exporters, which would boost investor confidence in companies within this sector.

A number of semiconductor-related stocks fell heavily today following the turmoil in U.S. markets. Lasertec Corporation (TSE: 6920), a designer and manufacturer of semiconductor testing equipment, saw its stock price plummet 5.16% today, making it one of the notable underperformers in the Japanese market. Market Commentators attribute this drop to the close correlation between Japanese semiconductor stocks and the U.S. semiconductor market performances. The PHLX Semiconductor Index fell 1.26% as of the report published time amid volatility driven by recent U.S. tariff fluctuations. Ongoing uncertainty in the U.S. market, fueled by frequent pauses and adjustments in tariff policies, has unsettled households and businesses.

Sumitomo Mitsui DS Asset Management at the beginning of this year predicted a positive trajectory for the Japanese stock market, emphasizing favourable factors like corporate earnings and improved governance could boost investor confidence in 2025, with moderate GDP growth (1.2% for FY 2025) and inflation (2.1%) supporting market optimism. However, current market performance shows a gap compared to forecasts, citing concerns over U.S. tariffs, rapid Yen appreciation, and Bank of Japan rate hikes.

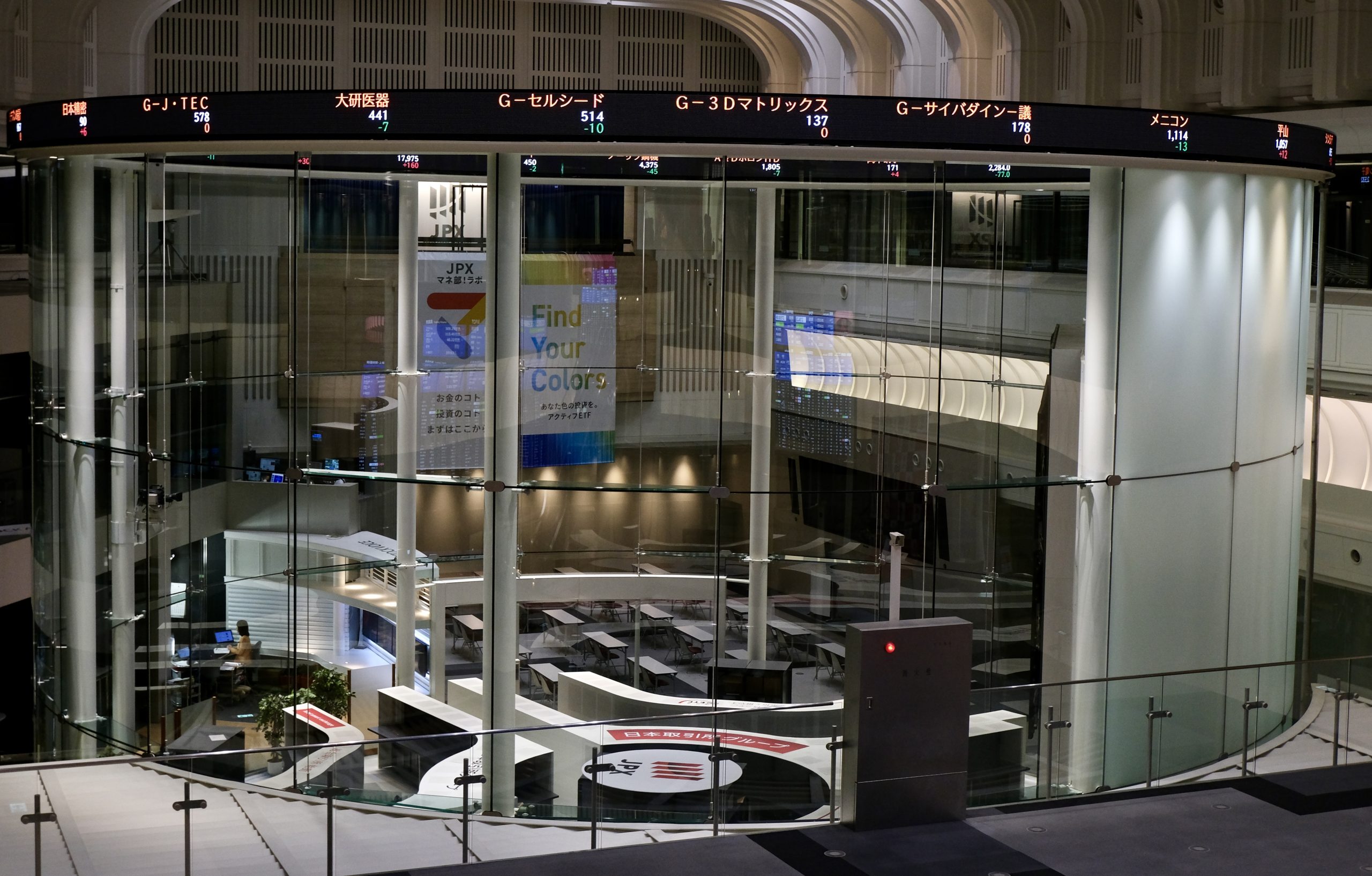

The Tokyo Stock Exchange was founded on May 15, 1878 as the Tokyo Kabushiki Torihikijo. It was temporarily suspended during World War II and resumed trading on May 16, 1949, and was renamed as it is today. There are 3,958 listed companies traded in the exchange, which includes almost every listed company in Japan. Most of the companies listed were local corporations, with only 6 foreign stocks.

Stock trading was done manually in the early days, when traders used gestures to identify the types of stocks and made trading decisions. As computers evolved in the 21st century, all exchanges have now gone online.

Unlike other stock exchanges like the New York Stock Exchange,TSE does not ring the bell at the opening and closing of the market every day, but holds a ceremony called "final session (大納会)" on the last trading day each year.

TSE is an affiliate of Japan Exchange Group (JPX), a financial instruments exchange holding company that owns a list of financial institutions, including Tokyo Stock Exchange, Osaka Exchange, Tokyo Commodity Exchange, and Japan Securities Clearing Corporation.

《The Young Reporter》

The Young Reporter (TYR) started as a newspaper in 1969. Today, it is published across multiple media platforms and updated constantly to bring the latest news and analyses to its readers.

Piu Sik parade returns to Cheung Chau on Buddha’s birthday

Number of visitors at the Osaka Expo hits record high

Comments